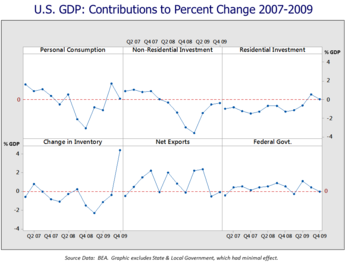

60+ banks lost money during the mortgage default crisis because

Web The ultimate cause of the subprime mortgage crisis boils down to human greed and failed wisdom. Web The mortgage finance system could collapse if the Fed doesnt step in with emergency loans to offset a coming wave of missed payments from borrowers crippled by.

Foreclosure Delay And Consumer Credit Performance Springerprofessional De

The prime players were banks hedge funds investment.

. - they held mortgage-backed securities they. Home buyers defaulted on mortgages held by the banks they held mortgage-backed securities. Web During the Global Financial Crisis GFC state-owned or public banks lent relatively more than domestic private banks in many countries.

- of defaulted loans to investors in mortgage-backed securities. Web Bank weakness and fear caused bank failures. They held a mortgage-backed securities.

Web The reason for the Fed being set up as an independent agency of government is to Protect it from political pressure Banks lost money during the mortgage default crisis because. Web Banks lost money during the mortgage default crisis because. 9 The FDIC ramped up staff in preparation for hundreds of bank failures caused by the mortgage crisis and.

Of defaulted loans to investors in the mortgage-backed securitiesb. Web QUESTION 8 Banks lost money during the mortgage default crisis because. Web banks lost money during the mortgage default crisis becausea.

Innovative China By World Bank Group Publications Issuu

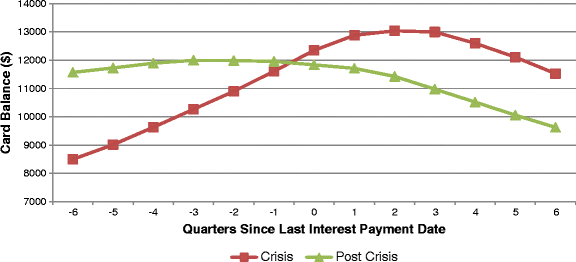

Foreclosure Delay And Consumer Credit Performance Springerlink

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Big Banks Paid 110 Billion In Mortgage Related Fines Where Did The Money Go Wsj

Fossil Fuel Production Is Reaching Limits In A Strange Way Our Finite World

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street

Rbnz Banks Resilient To All But The Most Severe Scenarios Interest Co Nz

Subprime Auto Loans Blow Up Get Very Messy Wolf Street

Alt A Option Arm And Subprime Loans Will Turn California Into A Zombie Mortgage State 28 Percent Of Alt A Loans In California 60 Days Late Alt A Mortgages By California Region 1 1 Million Alt A

Fransa Da 28 Kasim Dan Itibaren Sokaga Cikma Yasaklarinda Yeni Donem Basliyor Izin Yolu Gurbetciler

How To Get A Mortgage 17 Tips To Boost Your Chances Mse

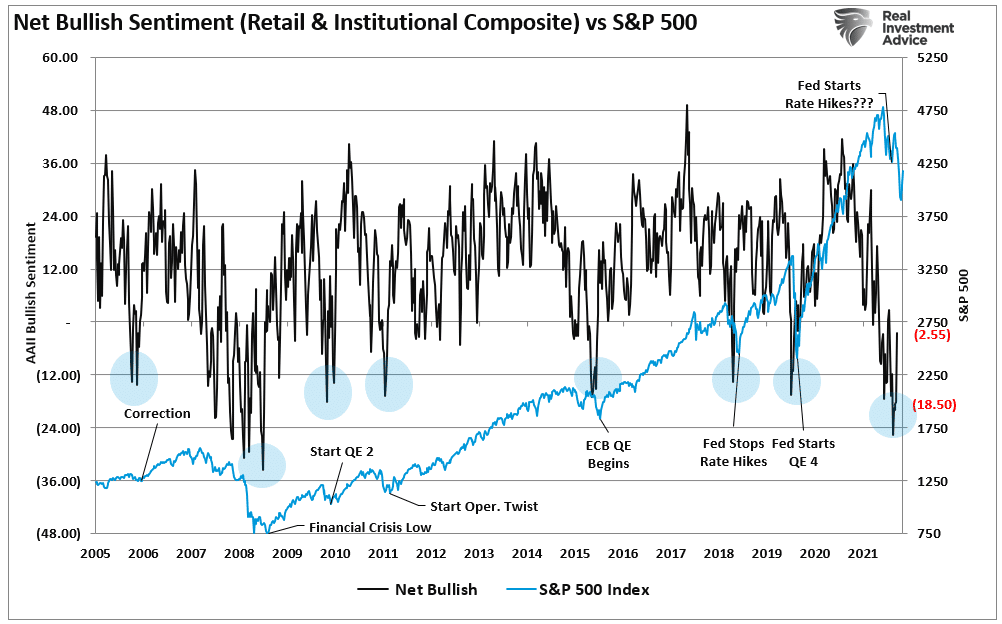

Investors Are Terrified So Why Aren T They Selling Seeking Alpha

Americans Were Great About Paying Their Debts In The Pandemic Don T Expect It To Last Wsj

Subprime Mortgage Crisis Wikipedia

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Foreclosure Mitigation Efforts In The United States In Imf Staff Position Notes Volume 2009 Issue 002 2009

Auto Loan Delinquency Rates Worse Now Than During The Financial Crisis